Stop loss and take profit levels are useful risk management tools that allow you to limit potential losses if the market moves against you and secure any profits earned from unexpected reversals. The LCG Trader platform provides you with multiple ways to set both stop loss and take profit levels to help you protect your trades.

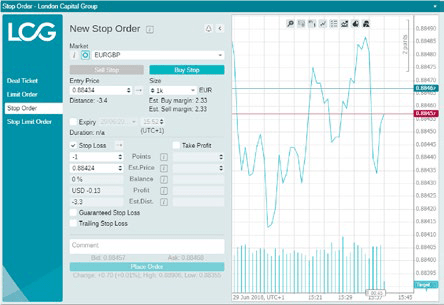

From the ‘Deal Ticket’ window, which appears after clicking the ‘New Order’ button, you can set both stop loss and take profit orders before your trade goes to the market. To choose when your stop loss or take profit order will be triggered, you can either set the exact price level or set a number of points away from your entry price. You can also select to place a guaranteed stop loss, although this includes an extra cost which can differ between instruments.

There are also multiple ways to set or edit stop loss and take profit levels after your trade has already been placed. If the chart of the instrument you are trading is active on the platform, you can drag the ‘TP’ and ‘SL’ sliders, which appear above and below your trade on the chart, to the desired positions to set your levels.

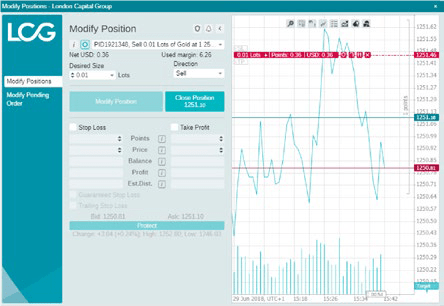

Alternatively, you can right-click on your open trade in the ‘Positions’ window and select ‘Modify Position’ from the menu that appears. From the ‘Modify Positions’ window, you can edit your stop loss and take profit levels and submit your changes by clicking the ‘Change Protection’ button.

Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level (jumps from one price to the next without trading at the levels in between), it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

Change Language ▼

Change Language ▼