Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

Spread betting and CFD trading are high risk and may not be suitable for everyone. You can lose all your deposits.

Weekly Trading Plan (July 23, 2018)

Investors will also focus on corporate earnings which will dominate in the week ahead, along with any volatility arising from the ratcheting up of trade rhetoric. Attention will also fall on the U.S. advance Q2 GDP report, which is likely to top 4.0% just ahead of the July 31, August 1 FOMC meeting. Trump has made it clear that he does not like higher interest rates.

EU President Juncker meets with Trump and will have his hands full in attempting to bridge differences on trade. UK PM Theresa May and Brussels will no doubt remain at odds on Brexit as well. The ECB meets, and it will fall on president Draghi to walk a fine line on the timing of the bank's first-rate hike after next summer. The U.S. economic data calendar in the week of July 23 will be dominated by Q2 GDP growth, though we will have to wait until Friday for the release.

EUR/USD

The EUR/USD continues to consolidate rising higher after briefly moving through the 10-day and 50-day moving average. Prices remain rangebound, and sideways trade makes fading rallies and buying dips the only strategy that has legs. Support is seen near last weeks lows at 1.1678. Resistance is seen at the July highs at 1.1790. Momentum is neutral as the MACD (moving average convergence divergence) index prints near the zero-level while the MACD histogram has a flat trajectory which reflects consolidation. The 43 print on the fast stochastic is in the middle of the neutral range and reflects consolidation.

GBP/USD

The rebound in the GBP/USD came on Friday as President Trump talk down the dollar and described his disappointment with rising interest rates. Prior to his comments Cable was in a downtrend and poised to test target support near the August 2017 lows at 1.2774. Resistance is seen near the 10-day moving average at 1.3173. Momentum is negative as the MACD line recently generated a crossover sell signal. The fast stochastic bounced near the oversold trigger level of 20, must as it made a crossover buy signal forecasting a short-term bounce.

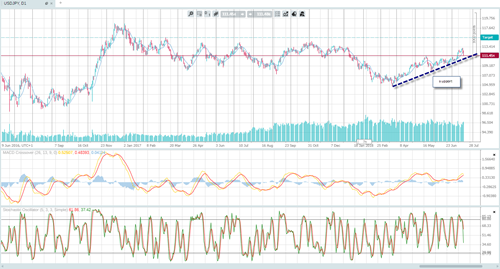

USD/JPY

The USD/JPY made a robust run, as dollar strength increased with rising U.S. rates. Despite Trumps comments, the Fed is likely to continue to normalize based on incoming economic data. Resistance is seen near the 10-day moving average at 112.05 which the exchange rate sliced through on Friday. Support is seen near an upward sloping trend line that comes in near 110.75. Momentum has quickly turned negative, as the MACD is poised to generate a crossover sell signal.

Wall Street

The Dow Industrials remain rangebound, as earnings season continues to show strong performance which has been offset with trade war concerns. Short term support is seen near the 10-day moving average which is 24,984. Resistance is seen near last weeks highs at 25, 215. Prices are forming a flag pattern, which will likely test the June highs near 25,402. Momentum is mixed, and turning negative as the MACD histogram reflects a negative trajectory as the fast stochastic reverses lower.

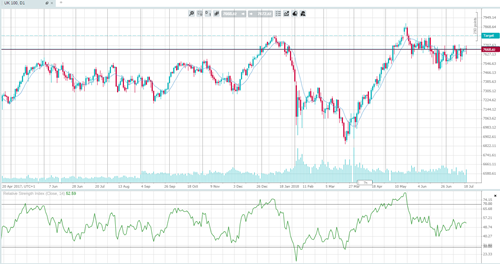

UK 100

The FTSE continues to consolidate. The exchange rate is rebounding but trade is very choppy. Prices are hovering near the 10-day moving average which is gliding higher. Support is seen near the 7,470 region. The RSI is moving sideways printing a reading of 52.6 which is in the middle of the neutral range and reflects consolidation.

Germany 30

The DAX reversed course on Friday and is forming a topping pattern, as prices are making lower highs, and failing to pierce through resistance. Short term resistance is seen near the 10-day moving average at 12,588. Support is seen near the June lows at 12,093. Positive momentum is decelerating as the MACD histogram trajectory declines.

Gold

Gold prices were on the ropes until the dollar turned Friday following Trumps comments with regard to the currency and interest rates. If the dollar continues to rise, it will generate headwinds for the yellow metal. Resistance is seen near the 10-day moving average at 1,239. Support is seen near the July 2017 lows at 1,204. Short-term momentum has turned positive as the fast stochastic generated a crossover buy signal in oversold territory.

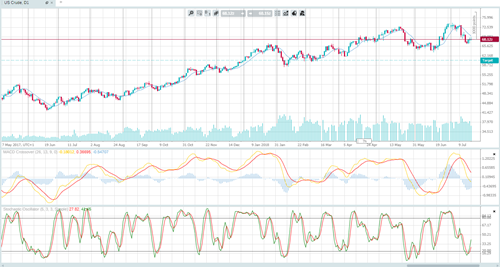

US crude oil

WTI crude oil prices edged higher as the Saudi’s announced declining output ahead for August. Prices appear to be rangebound, with resistance seen near the 10-day moving average at 70.14. Support is seen near an upward sloping trend line at 70.14. Short-term momentum has turned positive, which is reflected by the recent crossover buy the fast stochastic.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Please note that 79% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 71% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼