Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

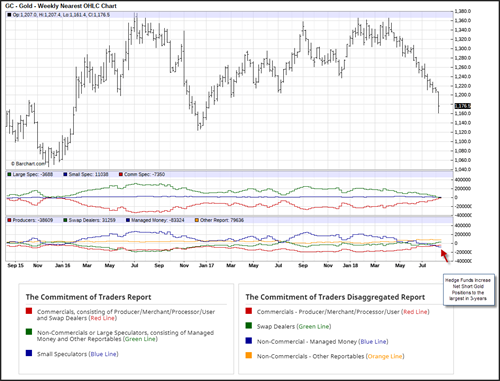

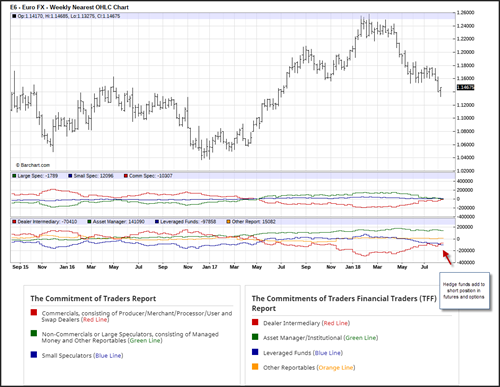

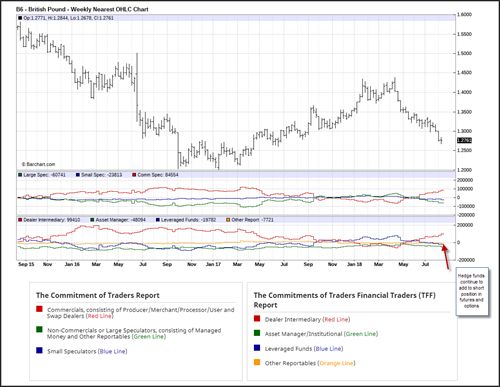

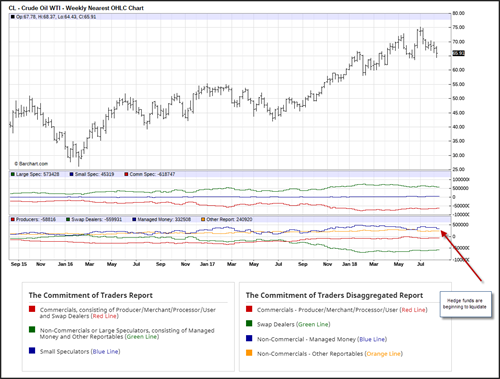

The Commitment of trader’s report reflects the position in futures and options held by swap dealers, managed money, leveraged traders and other reportable traders. If is released every Friday reflecting the positions of traders from the prior Tuesday by the Commodity Futures Trading Commission. You can use the COT report to help you determine if sentiment is too high or a trend is in place.

*Source – Barcharts.com

The chart above shows that leveraged traders (hedge funds) are increasing their short position in Gold futures and options. The chart also shows that historical negative sentiment has reached a 3-year minimum (maximum short) as hedge funds accumulated a short position where they are betting on a further decline in gold prices. This level is tenuous, as a rebound in prices could lead to a short-squeeze where prices surge and hedge funds head for the door.

*Source – Barcharts.com

The chart above shows that hedge funds continued to add to short positions, but negative sentiment has not reached its maximum hit in November of 2016. The rebound in the EUR/USD late in the week was not incorporated into this week COT report, which probably would show some covering. While negative sentiment is high, it is unlikely large enough to generate a significant short-squeeze that would create a significant rally in the currency pair.

*Source – Barcharts.com

The chart above short that leveraged funds (hedge funds) continued to add to short positions in GBP FX as position dollar sentiment continued into mid-week last week. While the sentiment is negative for the GBP, it is well above the maximum negative sentiment experienced in October of 2016. This will likely lead to continued choppy trading conditions.

*Source – Barcharts.com

Crude oil prices continued to trend lower as hedge funds exited long position in futures and options. Last weeks inventory report showed an unexpected increase in stockpiles of U.S. crude oil, which lead to profit taking. The very large long position is still intact as hedge funds are betting that the unraveling of the Iranian nuclear deal will push crude oil prices higher. The high positive sentiment could lead to a continue to lead to a long liquidation.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 79 % of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 71% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼