Foreign exchange, often abbreviated as forex or simply FX, refers to the exchange of global currencies on a decentralised market place – also known as over the counter (OTC) currency exchange. The foreign exchange market is the largest and most liquid market in the world, with an average daily trading volume of approximately $5 trillion. There is a lot more forex trading than other forms of investing. The size of the currency market dwarfs bond and equity markets where daily volumes are much lower.

Who Trades on the Foreign Exchange Market?

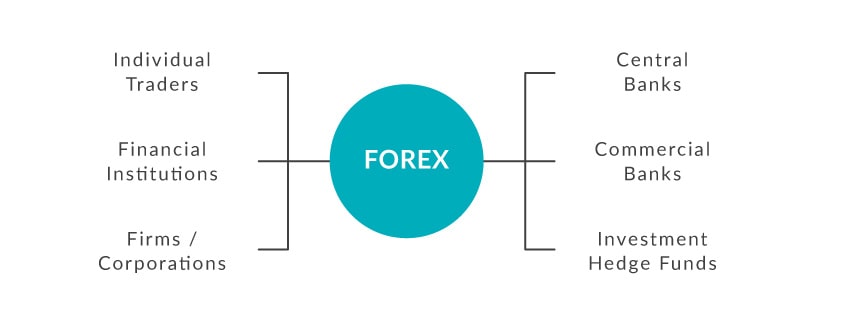

Historically, the currency market was only accessible to large financial institutions and high net worth individuals, however, technological innovations over the last two decades have enabled investors of all sizes to buy or sell currencies on the forex market from anywhere in the world, through the use of innovative online trading platforms. Some of the main participants in the foreign exchange market include:

Governments and Central Banks

Major national governments and their respective central banks including the Federal Reserve, the Bank of England and the European Central Bank are some of the largest players on the forex market, using currency exchange to manage money supply and make changes to monetary policy.

Major Banks

Some of the world’s largest banks such as Goldman Sachs, Deutsche Bank and Citibank trade immense volumes of currency on the forex market on a daily basis, both for themselves and their clients which include major corporations, government agencies and high net worth individuals.

Forex Brokers

Forex brokers provide access to the global currency markets to retail traders of all sizes. Through online trading platforms, a broker acts as a gateway for investors to trade currency from the comfort of their own homes.

Retail Traders

Almost one-third of the daily volume traded on the forex market is now supplied by retail traders. This means individuals are trading approximately $1.5 trillion of currency on a daily basis, gaining access to the market through the trading platforms supplied by forex brokers.

How Are Currencies Traded on the Forex Market?

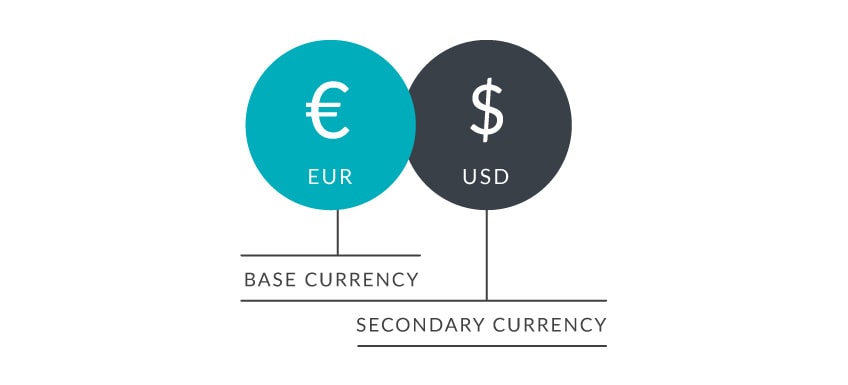

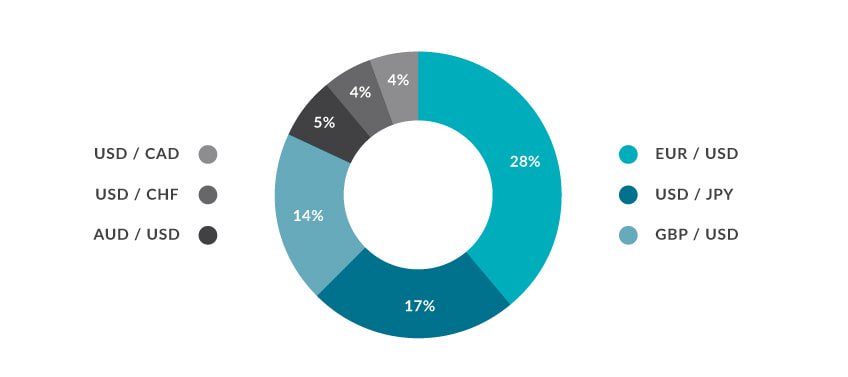

Currencies on the forex market are traded in pairs. This means that, when a trader goes to buy or sell a currency, they are simultaneously selling or buying another. For example, if a trader wishes to buy EURUSD, they will be buying euros and selling dollars at the same time. Currency pairs are often separated into three distinct categories:

Major Pairs

Involve the U.S. dollar paired with any other major currency. Examples of major pairs include EURUSD, GBPUSD, USDJPY and USDCAD.

Cross Currency Pairs

Pairs not featuring the U.S dollar. Crosses between other major currencies are also referred to as minors. Examples of cross currency pairs include EURGBP, EURJPY, GBPJPY and NZDCAD.

Exotic Paris

Involve a major currency paired with one from an emerging economy. Examples of exotic pairs include USDHKD, CADMXN, EURSEK and JPYSGD.

Trading a nation’s currency is akin to investing in the fortunes of said nation. When the country is doing well and its economy is thriving, its currency strengthens. Conversely, when a nation is struggling, its currency will be worth less. As such, investors in the forex market are speculating that one country’s economy will outperform that of another. For example, if a trader believes that the United Kingdom’s economy will outperform that of the United States, they would buy GBPUSD (buy the pound and sell the dollar). On the other hand, if the U.S. economy is likely to perform better than that of the UK, a trader would sell GBPUSD (sell the pound and buy the dollar).

What Affects a Currency’s Exchange Rate?

When looking to buy or sell currencies on the forex market, an investor must be aware of the factors that affect exchange rates, so that they can adapt their strategies accordingly. Two of the main factors to watch out for include:

Macroeconomic Events

Macroeconomic news including announcements about important data points such as inflation, unemployment, interest rates and gross domestic product can have major effects on a currency’s exchange rate. Investors watch this data closely for hints on how the markets may move.

Geopolitical Events

Geopolitics also play a major role in the prices of currency. Factors including changes in government, new regulation, taxes, labour laws and trade tariffs can all cause volatility in the forex market, and significantly impact the value of national currencies.

It is important for investors to keep abreast of all upcoming events and announcements that may impact currency prices, so as not to be caught off-guard in the case of market volatility. There are numerous tools including economic calendars that can be used to monitor market-moving events, enabling traders to adapt their strategies when necessary.

Change Language ▼

Change Language ▼