Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

Hello, welcome to LCG’s look ahead to the key events in markets for the week starting April 3rd, 2017. The video edition will return next week, and in a new location!

Stocks

Stock markets are consolidating near recent peaks and the big question is whether the ‘Trump Slump’ will pick up steam again, sending stocks lower. The long term uptrend in the Dow Jones (Wall Street) looks intact but things could get choppier in the short term.

European stocks are showing renewed signs of optimism with the DAX (Germany 30) index notching up a fresh two year high last week. Fears of an upset in French elections appear to be subsiding and Trump’s healthcare failure has increased political uncertainty in the US. As a result investors appear to be rotating into the relatively undervalued stocks in Europe.

FX

Article 50 was finally triggered last week and all eyes are on the pound for how it will handle the inevitable ups and downs of the negotiations. EURGBP should in theory be a better play on Brexit because the dollar typically plays an outsized role in dictating the trend in major currency pairs.

One month chart comparing EURUSD with GBPUSD and EURGBP

Source: Bloomberg LP

Numerous Fed speakers on message for 3-4 rate hikes this year saw the US dollar burst to life at the end of last week. The big test for the dollar this week will be the US unemployment report for March on Friday. Another topic to look out for will be any more details on Donald Trump investigating ways to penalise currency manipulators (i.e. China, Japan and Germany).

Commodities

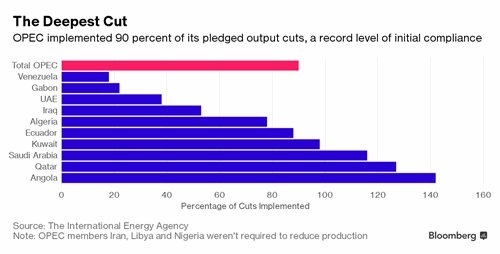

Oil prices rebounded last week with OPEC seemingly managing to convince investors that compliance with output cuts has improved in March. US inventories continue to rise and we suspect there isn’t the political will inside Saudi Arabia for further cuts so upside could be limited.

Chart displaying percentage of cut towards OPEC output target

Gold’s dominance as the best performing asset class this year showed signs of withering again at the tail end of the week. The precious metal losses are very much correlated with a bounce in the buck. We suspect gold could be headed into a new period of consolidation.

Economic Data (BST)

European manufacturing (Mon, multiple)

ISM Manufacturing PMI (Mon, 1.30pm)

European services PMIs (Weds, multiple)

US ADP employment (Weds, 1.30pm)

UK industrial production (Fri, 9.30am)

UK Trade Balance (Fri, 9.30am)

US Nonfarm payrolls (Fri, 1.30pm)

US Average hourly earnings (Fri, 1.30pm)

Earnings highlights

ASOS, Audioboom, AA, HSS Hire Group, Monsanto, Walgreens Boots,

That’s it from LCG’s week ahead. Thanks very much for reading and good luck trading this week.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Losses can exceed deposits.

Change Language ▼

Change Language ▼