Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

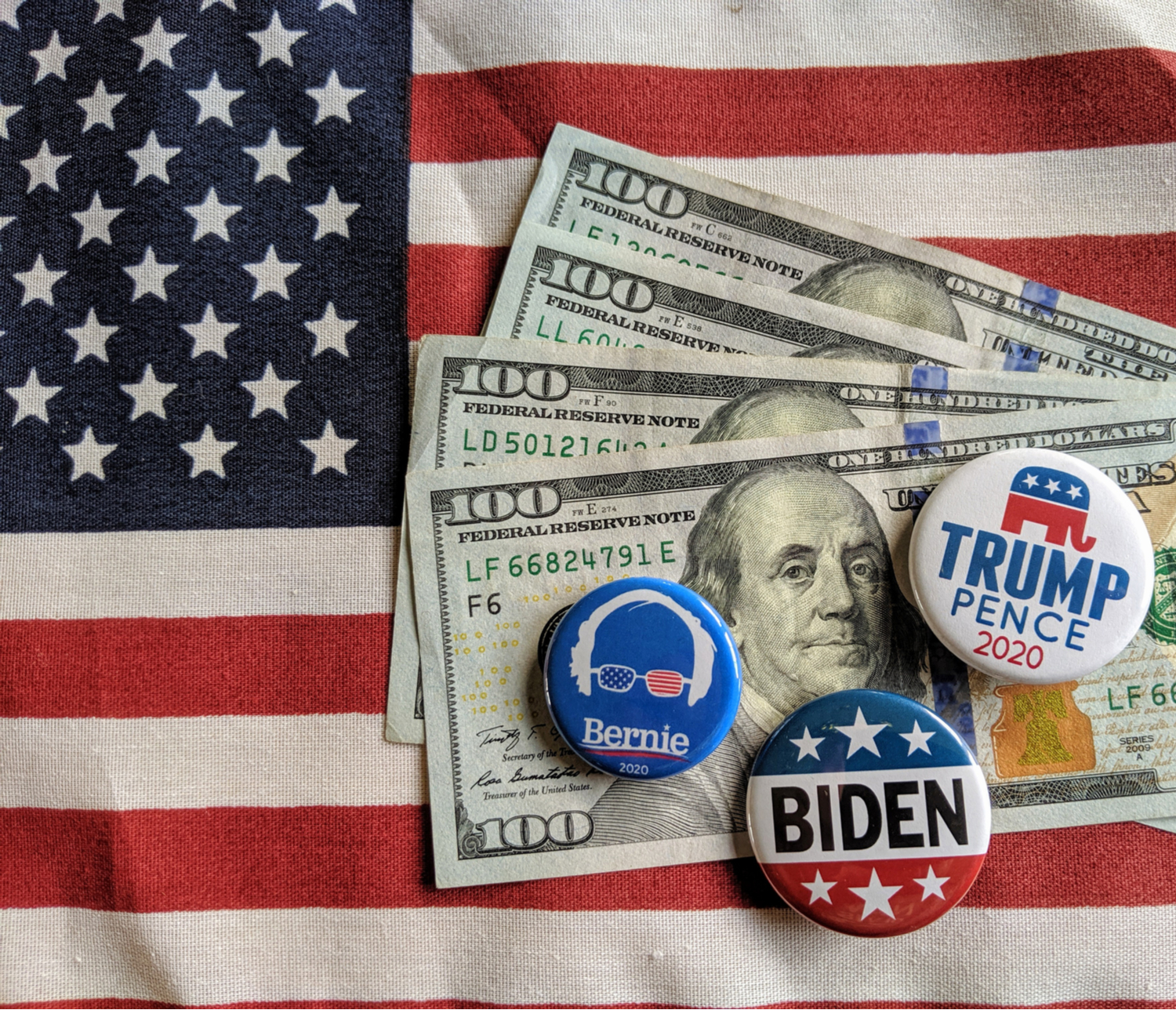

Shares in Europe look set for higher open following the wake of a ‘Biden bounce’ on Wall Street. The Dow saw another +1000-points day led by healthcare companies on the hope the US can avoid a national healthcare service under a President Sanders. Actually, we think Bernie has a great shot at the Presidency second time around and these healthcare company gains won’t be sustained.

Chinese shares are up another 3% on Thursday amid more calls for central bank easing. There are reports that Chinese companies have been falsifying ‘back to work’ statistics. Markets had already called BS on Beijing’s coronavirus stats now the focus has shifted to the RoW COVID19 outbreak.

The FTSE 100 looks set for modest gains as airline Flybe files for bankruptcy. Flybe has been on the brink too many times and the coronavirus tipped it over the edge. For a bailout to happen Flybe needed debtholders to see a clear path to profitability this year. Instead most airlines are cutting capacity and gritting their teeth for what will likely be the worst period for the industry since the European debt crisis.

US futures are pointing to a lower start on Wall Street after California raised a state of emergency. Congress has approved $8bn in funding to the fight coronavirus which should reduce the duration of the outbreak, but the short-term intensity is out of anybody’s control. And that includes the Fed.

Oil prices are flat on Thursday awaiting a decision (or lack thereof) from OPEC and its partners in Vienna. As of Wednesday Russia is not budging. Reports are that the Saudis want 1.5M barrels per day. Oil is in a holding pattern now, but the risk is that if the cartel prevaricates too long, the floor gives way. We have a $40 target on Brent on any agreement less than ¾ barrels per day and a sub-30 target on no agreement at all.

In FX markets the Loonie is little changed after the Bank of Canada matched the Fed’s shock and awe tactics with their own. It’s an odd environment where a cut is expected from almost every central bank. The price action since the RBA and BoC cuts show forex traders are favouring the currencies of the most proactive central banks. A Bank of England rate cut is now fully priced in. But fortune favours the brave. We think the pound stands to outperform if the BOE took a leaf out of the Fed’s book and went early before the March 26 meeting.

The euro has come off its highs thanks to Italy going into virtual lockdown and the glacial pace toward fiscal expansion in Germany. Serie A football matches being played in front of empty stadiums will like a scene from the apocalypse. The European Commission is looking to revise down its European growth targets and sees the risk of Italy and France going into recession. The sad truth is it will take a severe outbreak in Germany for a decisive fiscal response.

Gold is little changed after its massive $50 in one day ramp up on Tuesday. There is a clear trend of monetary easing that supports higher prices in hard assets. But that is also aiding risk sentiment short term which is limiting gold’s appeal.

Opening Calls:

FTSE 100 is set to open 13 points higher at 6828

DAX is set to open 71 points higher at 12198

S&P 500 is set to open 36 points lower at 3094

Change Language ▼

Change Language ▼