Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

CFD trading is high risk and may not be suitable for everyone.

29 Aug 2018

By Jasper Lawler

LCG Swedish election preview

The Swedish election is the latest test of Western democracy’s shift towards nationalism and populism. A swing to the hard right in Sweden could raise the political threat levels across Europe. If nationalists gain power in Sweden, it could influence the stability of the union and affect the value of the euro and European shares.

Need to know

The influx of asylum seekers, especially from Syria has made immigration one of the biggest election issues. Sweden’s relatively small population of 10 million people had the second-highest asylum applications per person during the Syrian refugee crisis of 2015.

Like in other European elections, mainstream political parties are offering a continuation of current immigration policy, leaving an opening for smaller parties to take a different approach. The issue of immigration could allow parties like the ‘Sweden Democrats’ to win a much larger share of the vote than they normally would.

Working in Sweden and the economy

The most desirable companies to work for in Sweden are Google, IKEA, Spotify, Tesla, Microsoft and Apple. This shows the preference for technically advanced careers with international ambitions. The gulf between the aspirations of Swedes and recent arrivals from countries such as Syria is wider than before. Previous waves of immigrants were typically better educated and more able to integrate into the mainstream Swedish identity.

A strong economy typically favours the incumbent government but the economy is not a hotly debated issue during this election. Stimulus through negative interest rates and a low exchange rate has helped fuel an economic (and housing) boom. GNP grew by 3.3% during 2Q18, building towards a 2.6% projected GNP growth for the year. Unemployment has fallen to 6% and state finances show a surplus. However, 2017 showed the lowest GNP per capita growth in the EU. Integrating new arrivals is part of the problem and it is difficult to grow from a position of high performance.

A risk factor for long-term investors in Sweden is that household debt has risen from 3,000bn SEK in 2014 to 3,900bn SEK in 2018. The increase in private borrowing has caused growth of 20% in the national debt.

What to expect

The 15-day average poll results as of August 26, two weeks before the election, is as follows:

Party - Vote Share (%)

Social Democrats - 24.5

Sweden Democrats - 19.9

Moderate Party - 18.5

Left Party - 9.3

Centre Party - 9.2

Green Party - 5.8

Liberals - 5.4

Although the populist Sweden Democrats might have the second largest vote share, the other parties have refused to work with them.

Over the past few years, the Sweden Democrats have been gaining voters from the traditional major parties, the Social Democrats and the Moderate Party. This has forced them into coalitions with smaller parties in order to form a minority government. There have been two major coalitions, the Social Democrats with the Left Party and the Green Party on one side and the Moderate Party on the other with the Liberals, the Christ Democrats and the Centre Party.

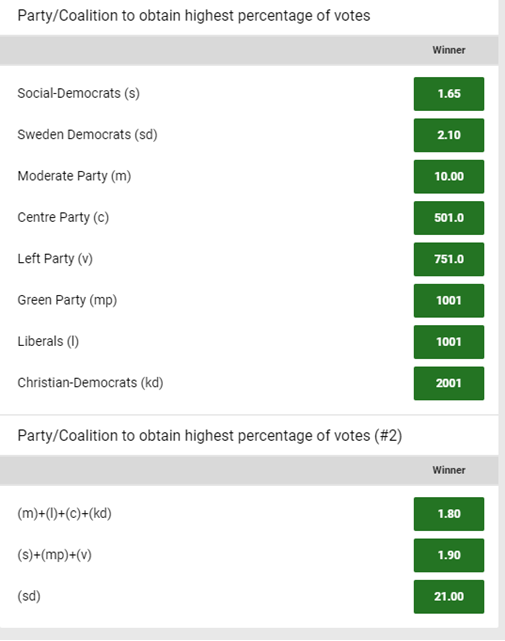

This becomes interesting when looking at some betting odds for election outcomes. Social Democrats are expected to get the most votes, yet the Moderate Party coalition is slightly favoured to get a higher total number of votes than the Social Democrats coalition.

(Source: Unibet, 28/8/2018)

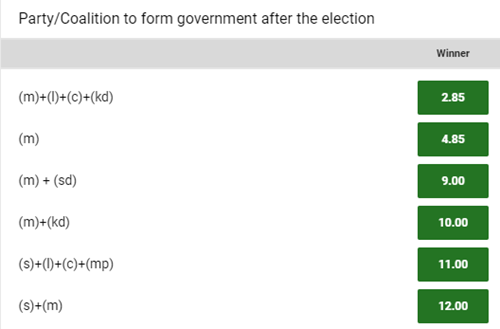

However, the key expectation is that the Moderate Party coalition is heavily favoured to form a government.

(Source: Unibet, 28/8/2018)

The Moderate party coalition is most likely to form the government partly because they get along better with their coalition partners than the Social Democrats do with theirs, but also because they are known to agree with the Sweden Democrats on some key issues.

The Swedish parliament, the Riksdag, has 349 seats, which are delegated to the parties proportionately according to the number of votes they get in the election (as long as it above a 5% threshold). Hence, 175 seats are required for majority. Anything short of 175 seats means the government will need support from outside of the coalition. A minority Moderate party coalition is less likely than a Social Democrats coalition to have important government agenda like the budget blocked by the Sweden Democrats.

Market reaction

We think if the Sweden Democrats were to gain the largest vote share and/or 25% of the vote, investors could start to price in more EU political risk by selling euros.

The euro (EURUSD)

The result in Sweden would need to be an extreme one to cause any fear of contagion across Europe. Sweden is not in the Eurozone so the election does not have the same kind of ‘breakup risk’ associated with elections in France and Holland. We think, if the Sweden Democrats were to gain the largest vote share and/or 25% of the vote, investors could start to price in more EU political risk by selling euros.

The Swedish krona (EURSEK, USDSEK)

The Swedish krona would likely see the first market reaction once the result becomes clear on Sunday evening/Monday morning. Any reaction in the krona to the election is likely to be temporary because the party that is elected is unlikely to influence the monetary policy of the Riksbank. The Riksbank has been driving the SEK weakness via negative interest rates, a policy other central banks are in the process of reversing.

EURSEK Weekly candlestick chart

(Source: LCG Trader, 28/8/2018)

The krona has been in a persistent downtrend against the euro since the last election four years ago. Success for the Sweden Democrats should cause Krona strength i.e. a dip in EURSEK, but that may ultimately prove to be a dip-buying opportunity in line with the longer-term uptrend.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 79 % of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼