Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

- Libra will expose 2 billion Facebook users to crypto

- Stablecoins like Libra don’t compete with Bitcoin

- Bitcoin back in a bull market

Today Facebook is set to release a whitepaper about its new cryptocurrency dubbed Libra. Libra could mark the beginning of the end of Bitcoin, but we don’t think so. Libra’s release is bullish for cryptocurrencies.

The whitepaper should give specifics about how Libra will function and offer more on its intended usage by Facebook. It is probably fair to assume Facebook will use Libra as a cheaper means of payment on its platform, similar to what it is already doing with WhatsApp in India. Transactions will also be perfectly trackable via the blockchain to aid Facebook in its targeted advertising.

Libra will expose 2 billion Facebook users to crypto

Because of its huge network of over 2 billion users, Facebook products cast a wide net. Libra will breed familiarity of cryptos to a much wider audience. Two billion people will now be much more open to Bitcoin and other altcoins. The situation is comparable to when Amazon began its prime video service and its implications for Netflix. Amazon bringing streaming to the mainstream was a bigger upward force to Netflix shares than any negative effect from competition.

The exposure of this many people to cryptocurrencies should spur regulators into action. The wild-west of unregulated cryptocurrencies has less chance of mass-adoption. Can-kicking big decisions like how to regulate cryptocurrency ETFs are more acceptable while cryptocurrencies are a speculative niche. Regular usage by 2 billion people means regulation of cryptocurrencies is needed asap.

Stablecoins don’t compete with Bitcoin

As a stablecoin, Libra will be tied to the value of a basket of real-word currencies. This means its own value will not be open to speculation. If traders want to speculate on the positive influence of Libra on the world of crypto, the most obvious route is via Bitcoin.

The different properties of a stablecoin compliment rather than compete with cryptocurrencies like Bitcoin, Ethereum and Ripple. Being pegged to regular currencies make stablecoins less volatile and more suited to payment processing. The value of cryptos like BTC and ETH is derived from the eco-system (ie user community and products/applications that drive usage and volume. Michel Harding, a crypto expert and research fellow at Lancaster University says that Libra “Possibly reinforces bitcoins position as a digital gold and makes it less about remittance.”

Crypto architecture being put to use by Facebook increases the likelihood of mass adoption of the other cryptocurrencies and the unique benefits that their ecosystems offer. For example, it is probably fair to assume that decentralisation and privacy will not be features of Facebook’s Libra.

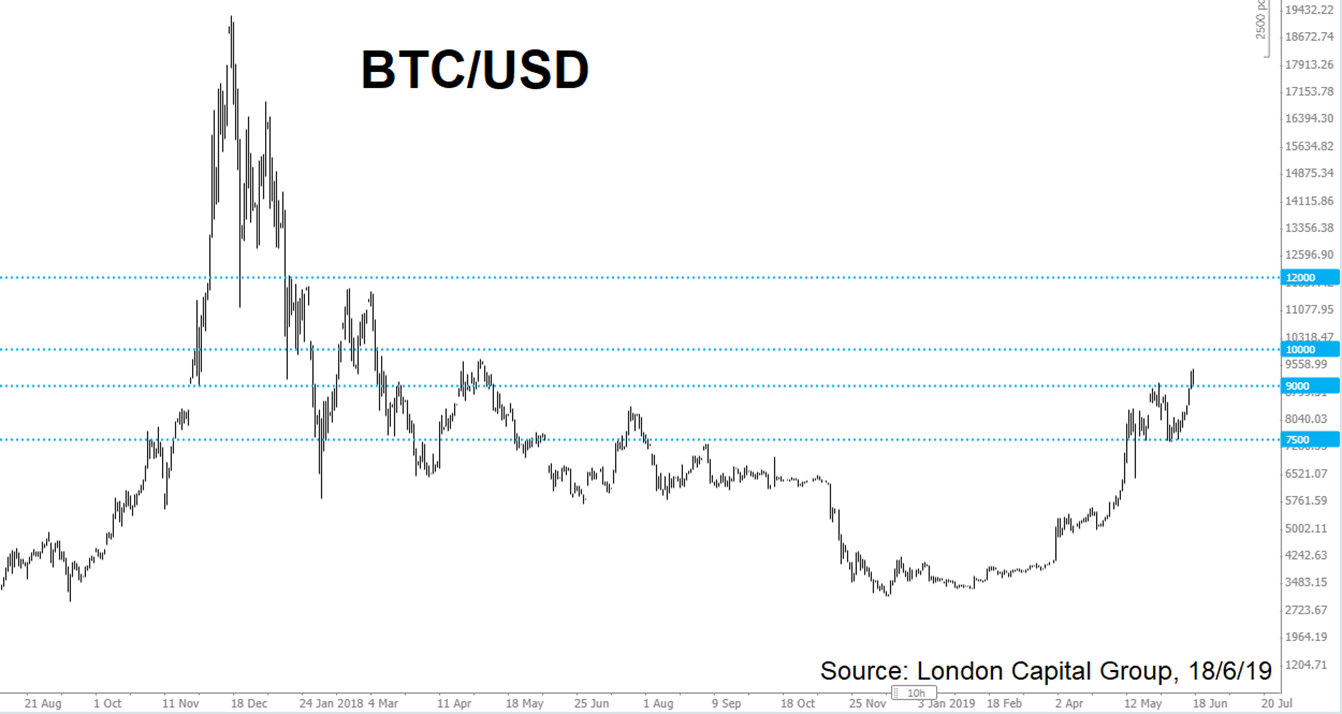

Bitcoin bull market

Bitcoin is back at its highest price in over a year and is up over 140% in 2019. Since regaining 6,000, traders have set their sights on the big 10,000 level. We see the retracement from 9000 to 7500 as complete. The news on Libra is to some extent baked in already but sets a nice backdrop for a push through 10,000.

Bitcoin daily bar chart year-to-date

Change Language ▼

Change Language ▼