Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

A quick summary of key global dynamics that could change in 2018. We discuss politics, economics, central banks, markets and the potential impact on market pricing. Topics include Bitcoin, FAANG stocks, inflation and gold.

(Geo) Politics

A Tory Party leadership contest

Theresa May lived up to her reputation as a scrapper in 2017 after a calamitous snap election and tough Brexit talks. But rivals are waiting to pounce in the wings and local UK elections could provide an opportunity. Should there be a leadership contest, the British pound would likely suffer, possibly to the benefit of the FTSE 100.

Mueller digs up Russian dirt on Trump

Maybe after ex-national security advisor Michael Flynn got caught lying, special prosecutor Mueller is getting closer to finding something that can stick in the Russia collusion investigation. Trump in trouble shouldn’t affect tax cuts but would hurt Republican chances in mid-term elections and derail other plans like deregulation, possibly to the detriment of US stocks.

North Korea goes quiet

The threat of nuclear and/or missile tests were always simmering in the background during 2017. Should diplomacy takeover in 2018, there would naturally less of a bid for havens like gold.

Populists do well in Italian elections

The Five Star Movement and the Northern League populist parties in Italy have sensibly toned down anti-euro rhetoric that hurt populists like France’s Marine Le Pen in 2017. This means less risk in FX markets but a better chance of populists getting the grey vote and winning a bigger vote share, potentially to the detriment of Italy’s FTSE MIB share index.

Economics

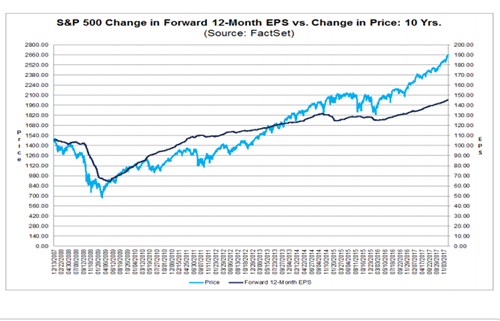

US earnings growth slows

Rising earnings, particularly in the energy sector, were one reason behind the big gains in US stock market this year. For Q4 2017, the estimated earnings growth rate for the S&P 500 is 10.6% according to FactSet. Should the earnings picture deteriorate in Q1 and Q2 of 2018, that would be a headwind to more equity gains.

US & EZ inflation picks up

Markets are starting to take for granted that central banks constantly overshoot inflation forecasts. If central banks get it right in 2018 and inflation picks up, that could push bond yields up and bring bond prices and potentially stock prices down with them.

Chinese authorities end support

With the five-year ‘People’s Party Congress’ out of the way, President Xi Jinping has already started to de-emphasise economic growth in favour of structural reforms. This could mean less fiscal stimulus which might take some of the heat out of the rally in industrial metals like copper.

Central banks

The ECB turns hawkish

The euro rallied for most of 2017 ahead of the European Central Bank tapering announcement, despite dovish language from the ECB. If the ECB turns hawkish, it could cause an even more abrupt appreciation in the euro, rise in bund yields and slump in European stocks.

Jerome Powell changes tact

Jerome Powell voted in sync with Janet Yellen in every meeting while on the FOMC so policy should remain consistent. Should Powell turn political as Fed Chairman, it may lead to a more gradual pace of tightening and thus a weaker dollar.

BOJ sets a higher target yield

The Bank of Japan is going to have to start falling in line with the tighter policy at other global central banks sooner or later. Should its yield target increase, JGB yields should increase and help an appreciation of the yen (USDJPY falls).

Markets

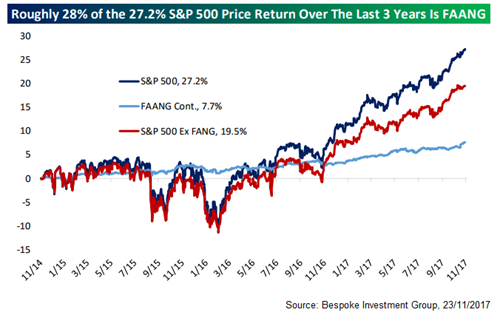

FAANG stocks rollover

A rotation out of tech has been a popular but unsuccessful end-of-year call over the past few years. The top technology stocks have been top performers for so long that the risk is when they finally do rollover, it’s not just a rotation but they take the entire market down with them.

Gold finally bottoms out

Precious metals have been trading sideways since making multi-year lows in early 2016. 2018 might finally be the year that gold-bugs return with conviction, with a break above $1400 per oz. The inverse relationship between stocks and gold has broken down of late but could return should gold start to trend again.

Another flash crash

Besides a mini crash in gold and a crypto crash in Ethereum, 2017 was devoid of flash crashes. The last notable flash crash was the British pound on October 6, 2016. Liquidity remains thin so the odds of another market-destabilising flash crash in 2018 seem high.

Bitcoin bubble bursts

The price of Bitcoin was stumbling at the end of 2017 near $20k but with predictions of $100k abound, it takes a brave soul to bet against it rising further. Still, should one of its typically large pullbacks extend more than 50%, and stay there, belief in the next monetary system could quickly evaporate.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Losses can exceed deposits.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 71% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼