Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

High volatility can cause anxiety for traders and investors but with a different

How to think about volatility?

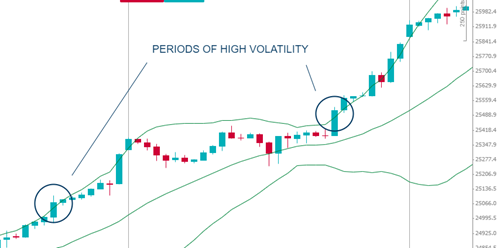

The basic pattern is that the market moves from a period of high volatility to a period of low volatility and back again. Sharp bursts of activity up or down follow periods of relative calm. Periods of calm are an opportunity to plan for the large price moves that will accompany the storm.

The VIX Index, published by the CBOE, is probably the most popular measure of market volatility, but there are others. Bollinger bands are a good way to

Wall Street - 4hr Candlestick chart

Source: LCG Trader, March 2018

Markets spend most of the time in periods of low volatility, with much less frequent shifts into high volatility. One logical conclusion from this is to assume low volatility, but prepare for high volatility.

How to trade with volatility?

Volatility can and should be used to a trader’s advantage. It all comes back to a trader understanding and believing in their trading system. It is important to understand at what point during the ‘volatility cycle’ the trade will take place.

There are two variants commonly used by traders.

- Trade in low volatility, and wait

These traders enter positions in the “calm before the storm”. This is typical during trend consolidation, or within a price range before an expected breakout. This approach requires the trader to avoid closing the trade for a small win or loss when volatility is still low; it requires patience. Once the volatility begins, traders will look for a quick exit if

- Wait for high volatility and jump in

What traders do here is wait for a new low in a trend downwards or a new high in an upwards trend. The break of these levels typically coincides with an increase in volatility. Here the important thing is to make sure to place the trade when volatility picks up. A trader must avoid any concern that it is too late or that the price will reverse because the strategy is to wait and then assume the volatility will continue.

Incorporating volatility into the understanding of a trading strategy can greatly improve trading success. A good starting point to learn more about volatility and other technical indicators is to study LCG’s tools for technical analysis.

Change Language ▼

Change Language ▼