Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

Earnings preview

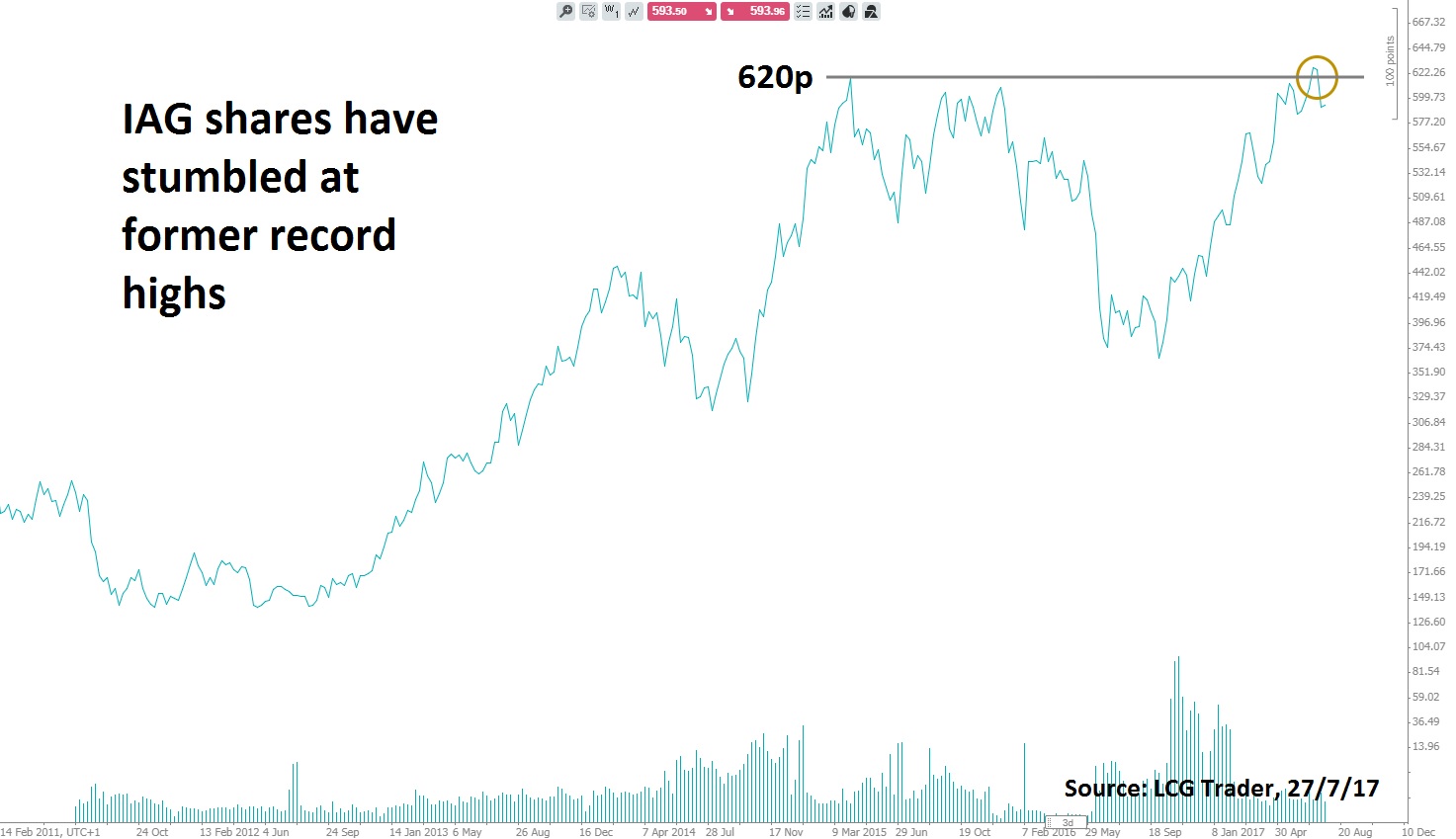

Shares of International Consolidated Airlines Group (IAG) hit all-time highs in July on optimism that persistently low fuel costs and rising passenger demand will bolster profits. IAG shares hit some turbulence recently when other airlines pointed to an intensifying industry price war during the second half of the year.

Strong results from other airline operators, positive monthly passenger data and sliding fuel prices suggest it will be another good quarter for IAG. In June IAG posted a 3.9% y/y rise in airline traffic and group capacity rose 3.5%. The second quarter comes off a surprisingly strong first quarter, traditionally the most dismal of the year, where operating profits rose 10%.

Three factors standout when studying the outlook for IAG; its response to the BA June IT meltdown, the effect of staff strikes and where it stands in the industry price war.

BA June IT meltdown

The upshot is that it’s too early to tell how badly IAG has been affected by the power outage at British Airways in May. Most business and holiday bookings for June will already have been made by the time the power outage took place. Judging by June airline traffic, the power outage in May hasn’t stopped passengers flocking onto BA flights for their summer holidays.

In the context of the slipping brand appeal of British Airways, the biggest risk from the power outage is reputational damage. So far that hasn’t materialised in the numbers. With approx. 75k passengers grounded during the power failure, we’d expect the negative influence to materialise in second-half of this year and even next summer’s bookings.

It’s also worth considering that in the eyes of passengers booking their flights, BA is not the only airline that’s had IT problems. In August last year, Delta Air Lines computer systems had an outage and last month an outage at Lufthansa and Air France prevented the boarding of passengers.

Cabin crew strikes

Staff morale is of the utmost importance for any business so the ongoing conflict with British Airways mixed fleet cabin crew is a clear negative for IAG. BA will have negated a good chunk of the negative impact of the Unite union walkout on its service to customers by leasing aircraft from Qatar Airways.

Future walkouts are planned through August 1 and BA plans to again lean on Qatar Airways again pending CAA approval. To maintain the high quality of service customers expect, BA will need to resolve the pay dispute with its cabin crew but in short-term, the only significant cost is leasing the Qatari aircraft.

Price war in airfares

The drop in IAG shares when Ryanair chief executive Michael O’Leary warned that fares would fall further in H2 demonstrates concern from shareholders that BA and Iberia can be ensnared in the price war.

Nonetheless, British Airways transatlantic business has held up well compared to Europe's highly competitive budget market. The shares of flag carriers have doubled the returns of low cost carriers (LCCs) year-to-date according to Goldman Sachs. Flag carriers like BA and Iberia have been benefitting from a cyclical recovery in long-haul pricing while low fuel prices have triggered a price war amongst budget airlines.

If short-haul prices continue to drop (Ryanair expects 5%, in the six months to September) that could force financially weaker airlines out, meaning greater market share for the likes of RyanAir but also IAG. A potentially more negative dynamic for IAG is budget airline Norwegian Air making the crossover to long haul. As Norwegian gains traction in its 10 new long haul routes, we’d expect long haul prices to be dragged lower.

Average Q2 estimates:

Earnings per share: 0.28 euros (up from 0.18)

Net income 502m euros

Revenues: 5.7bn euros

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Losses can exceed deposits

Change Language ▼

Change Language ▼