Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

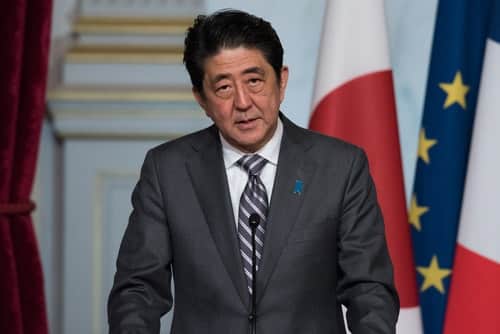

Japanese stocks strike 26 year high

Japanese stocks returned from holiday trading with a bang. The Topix index struck a 26 year, tracking the optimism that’s seen Wall Street close at record highs in the past two trading sessions. The energy sector was leading the charge in Asia after oil prices climbed again. At the same time activity in Japan’s manufacturing sector rose to a 4 year high according to survey data.

Oil rise signifies growth optimism

The ongoing surge in oil prices is symptomatic of bolstered growth sentiment that is also catapulting shares higher. There has been a noticeable uptick in global growth expectations. Economic data across the developed world is hitting multi-year highs. This is generating interest in growth-sensitive markets like US and EM shares, oil and high-beta currencies.

China Service sector activity on the rise

The Caixin China services PMI saw a surprise jump in December, hitting a three-year high. The data came in at 53.9 in December, up from 51.9 and higher than the 51.8 expected. A surge in new orders is helping keep business confidence robust in China. But question marks remain over how much government support has been propping this up.

S&P500 surpasses 2700

S&P 500 cracked 2700 for the first time ever in a day that saw the Dow, S&P500 and Nasdaq hit new record highs. The Dow beating its next big milestone of 25,000 in the next day or so seems a likely proposition. Demand for energy and tech sector shares kept up the record start on Wall Street as Fed minutes pointed to further growth ahead. Minutes from the December FOMC meeting showed members revised higher growth expectations thank to the passing of Trump’s tax cuts. The Fed have in effect have added fuel to the fire of belief in stronger US tax cut-supported growth.

European stocks looking at a strong open

Stocks in Europe are poised for a much higher open on Thursday, tracking the records on Wall Street and multi-decade highs in Asia. A successful first day of trading under new Mifid II rules may also be bringing some hesitant investors back into the fold. Next has offered some surprise post-Christmas cheer for retailers after reporting some upbeat sales results. Some near-term optimism that UK consumers splurged again over Christmas could prompt more bargain-hunting from investors in the retail sector.

Fed minutes cap gold’s record run

Gold finished the day lower on Wednesday after Fed minutes came in more hawkish than expected. Fed policymakers seem to be standing firm on their belief that low inflation is “transitory”. That implies no plans to back-down from another three rate hikes this year. Market expectations for another hike at the March meeting have improved. Fed funds futures now imply a 75% chance of a rate hike in March. Markets still aren’t convinced the Fed will achieve its policy-tightening goals so gold still has potential to rise this year.

Change Language ▼

Change Language ▼