Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

CFD trading is high risk and may not be suitable for everyone.

IMF Hard Brexit warning: another excuse for no rate rise

According to the same IMF report, “among the most exposed economies to Brexit-related adverse shocks,” are Britain’s closest neighbors like Ireland, Netherlands and Belgium. The lack of progress between the UK PM May and Brussels on critical issues on the UK's divorce bill implies that the risks of a hard Brexit are bigger now than they were a month ago.

The Sterling exchange rate reflects the tensions around the Brexit talks. Despite its impressive euphoric rally at the beginning of the year, GBPUSD is now down almost 3.6% YTD. The absence of any kind of agreement inside the UK or between the EU and UK in Brexit talks has to affect the Bank of England ability to pursue another interest rate hike.

The odds of a change in the BOE’s interest rate policy on August meeting have fallen dramatically. BOE Governor Carney also suggested that a hard Brexit will have severe economic consequences, and it will definitely require a swift review of interest rates. The recent resignations from Theresa May’s cabinet and with just over a week to go until the BOE decides on its interest rate policy we can expect the British Pound to be driven back and forth between the Brexit theme and the interest rate theme.

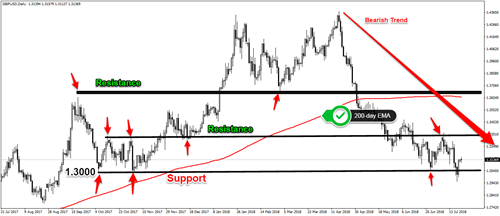

The GBPUSD technical pattern remains predominantly bearish while we trade below the key 200-day moving average and below the yearly opening price. However, we will only see the bearish momentum getting traction to the downside again once we clear out the big psychological number 1.30. The closer we get to a no deal Brexit scenario, the bigger the chance of a drop well below the big round number 1.30 and beyond.

In the short-term, the GBPUSD has the potential to fill in the previous week price range. But, the upside should be limited, and if we reach the intraday resistance level1.3230, we can expect the bears to show up.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Please note that 79% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼