Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

Political tension back on the rise

The people of Catalonia are set to hit the polls this Sunday (October 1st) for a hugely controversial referendum on its independence from Spain. The election comes as the euro fell to a 1-month low versus the dollar (EURUSD) and 2-month lows versus Sterling (EURGBP).

The Spanish government in Madrid does not want Catalonia to separate from the rest of Spain so it is actively trying to stop the referendum and has called it illegal. The political tension in Spain is heaped on top of souring Euro-area sentiment after Angela Merkel’s sub-standard German election result.

Why is Catalonia trying to secede?

Catalonia is home to Barcelona and has a rich industrial heritage, its own language and culture distinct from the rest of Spain. Catalonia lost its autonomy from Spain after the Spanish civil war (1936-39) under Dictator Francisco Franco, only to regain many lost powers under new legislation in 2006. Tensions have been on the rise since the Spanish constitutional court ruled that any reference to Catalonia as a nation was invalid in 2016.

Does Catalonia matter?

The referendum is not legally-binding. Catalonia cannot use the result to lawfully secede from Spain so the result has no immediate ramifications for Spain or the Eurozone, but it is not quite that simple. In the context of Brexit and rising populism, Catalonia voting to separate from Spain would cast a huge shadow over Europe. We view the long-term viability of the euro as hinged on EU fiscal integration.Europe avoided repeating the precedent set by Brexit in the French election. If Catalonia votes for independence, it puts break-up risk back on the agenda for investors in Europe.

Which way will the vote go?

Spain is doing all it can to stop the vote from going ahead, including deploying police. If it does ensue, the most likely result is that Catalonia votes for independence. The referendum is non-binding which means a protest vote has no direct consequence. The heavy-handed intervention from the government in Madrid will mean more inclination for a protest vote.

Spanish stocks have been underperforming

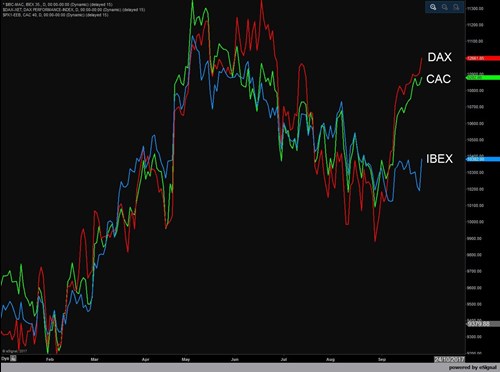

Spanish stocks have underperformed those in France and Germany since European stocks peaked after the French election in May. The Spanish equity benchmark, the IBEX hit 5-month lows in September. The IBEX is up 9.2% YTD (as of Sept 27) which is in line with the German DAX and French CAC indices. Investors have been voting on Catalonia with their feet.

The fear of massive asset devaluation during a breakup of the country has trumped Spain’s impressive economic recovery.In the event of a ‘no’ vote, we’d expect a relief rally in Spanish stocks on Monday. A ‘yes’ vote could generate a kneejerk sell-off, but that could be an opportunity. We suspect with the referendum in the rear-view mirror and during a bull market, a relief rally would still emerge in the days following.

Comparison chart for IBEX, DAX and CAC stock indices

Euro already struggling

The euro hit a one-month low against the dollar on Tuesday following its worst day in 2017 after the German election. The weakened position of Merkel’s leadership has brought to the surface some uncertainty about the workability of a ‘Jamaica’ coalition government. If no coalition can be found, there is a chance of another election. At the same time, there are signs the US dollar has found a temporary base, and that typically coincides with a top in the euro. Demand for the greenback is thanks in part to the Fed’s plans for shrinking its balance sheet in October and possibly raising interest rates for a third time this year in December.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Losses can exceed deposits.

Change Language ▼

Change Language ▼