Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

The dollar has been appreciating very quickly against the Chinese yuan in the last month. One question mark heading into today was whether China was deliberately devaluing its currency for competitive advantage in the trade war. In essence, a currency war. In order to deliberately devalue its currency, China would need to sell yuan into the open market by accumulating more US dollar reserves. Equally, to prop up its own currency, China needs to sell down its foreign FX reserves.

China End of July Foreign Exchange Reserves stood at $3.118T vs $3.112T at the end of June, rising $5.82B on the month. The fall in the value of the Renminbe seems to be led by market forces, not government intervention. The selling is just being ‘tolerated’ by China’s central bank, the PBOC. Today’s China FX reserves data suggests China is neither deliberately devaluing or supporting its currency.

The US has escalated trade war rhetoric again by threatening to increase duties on $200 billion of Chinese imports from 10% to 25%. China’s response is tit-for-tat, but it can only do that for so long. It’s worth remembering that China has a significant imbalance in terms of trade- hence the reason for this dispute. Its total US imports for 2017 were approx. $130 billion, which is vastly smaller than the $506 billion in goods that the US imports from China.

China can pursue other options to retaliate, like selling its US treasury holdings but this would be a self-inflicted wound because it would reduce the value of its remaining holdings. We suspect the limited options available to China means this theme of yuan deprecation and US dollar appreciation will continue into August. China will be happy to let currency markets take care of its trade dispute. The only reason China may decide to add to its FX reserves in August would be if the pace of further yuan depreciation accelerated.

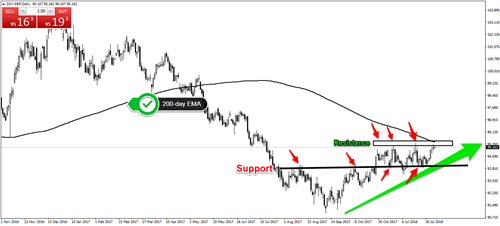

Source: LCG MT4, 7/8/18

In broader forex markets, the US dollar index has found resistance at 95 and its 200 day moving average. A break higher could set into a motion a longer term change in trend towards ongoing US dollar strength.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 79 % of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

Change Language ▼

Change Language ▼