Financial market research and analysis

Our analysts have their fingers on the pulse of the world's financial market news.

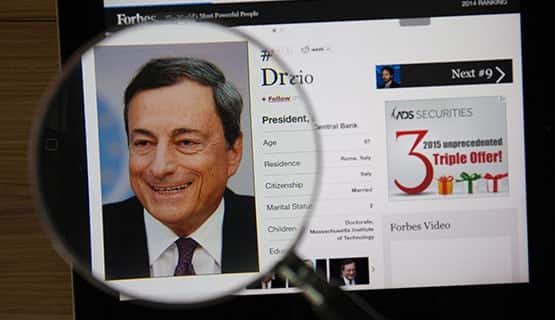

Following a two-day Governing Council meeting, the European Central Bank will give its policy decision on Thursday at 12:45 GMT. Market participants will be paying particular attention to President Draghi’s views on the eurozone economy and inflation expectations at his post meeting press conference. Whilst the central bank is not expected to make any changes to current policy, the ECB is expected to tweak the forward guidance.

Draghi to drop easing bias?

Given the solid recovery in the eurozone economy across 2017, it is becoming increasingly difficult for the ECB to stick with its easing bias in the forward guidance. After no tweaks were made in January, on Thursday Draghi is expected to drop the ECB’s pledge to increase its asset purchases if necessary from the statement. Any further, broader revision of the forward guidance is not expected until the summer.

However, don’t be fooled into thinking this will be a straight out hawkish meeting. In order to counteract the hawkish tweak to the forward guidance, we expect Draghi to portray an overall cautious tone to prevent, where possible, any strong unwanted increase in the value of the euro.

Draghi & Euro strength

Euro strength hasn’t been as much of a concern in the lead up to this meeting compared to the January meeting. The euro has dipped around 2% over recent weeks, although this hasn’t been the case on a trade weighted basis, where the euro continues to hover around a three-year high. However, in recent sessions the euro has rallied hard versus the dollar as trade war concerns have weighed on the greenback. Whilst increased euro strength is an added challenge for the ECB in trying to achieve its aim of 2% inflation, we expect Draghi to stick to his usual game of skirting the issue. We don’t expect any change from his usual line that the ECB does not target exchange rates.

Inflation forecasts

Draghi will update the market with inflation forecasts in the post meeting press conference. We are not expecting any significant changes to current forecasts. Eurozone inflation hit a 14-month low in February, highlighting that sluggish inflation remains a key challenge for the central bank, as it fails to pick up towards the ECB’s 2% target.

Concerns are edging higher that the eurozone’s recovery is stalling at the beginning of 2018, as the Citigroup economic surprises index drops into negative territory and to its lowest level since 2016. This reflects economic releasees coming in below consensus forecast. With the recovery stalling inflation may struggle to tick higher.

A word on trade wars

If Draghi takes a swipe at Washington over the growing fears of a trade war, it wouldn’t be the first time -just think back to Washington talking down the dollar. Trade war fears and the resignation of Trump’s economic advisor Gary Cohn have weighed on the dollar in recent sessions, boosting the euro. A continuation of this trend, of a stronger euro will further hinder the ECB’s aim of bringing inflation towards target, potentially pushing monetary policy normalisation further into the future.

Potential market reaction

EUR/USD is currently sitting at a two-week high at $1.2430, thanks to downward pressure on the dollar. The removal of the easing bias in the forward guidance is likely to result in a boost to treasury yields, which will push the euro higher, potentially to the psychological level of $1.25 before the targeting the three year high at $1.2555.

On the downside, should Draghi fail to adjust the forward guidance, or should he be heavy handed on the cautious tone, the euro could sell off towards a strong support line seen at $1.2360.

The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced. Losses can exceed deposits.

Change Language ▼

Change Language ▼